Custom Target Date Funds are Flaming Hot-- Don’t get Burned

[blockquote type="center"]Never test the depth of the river with both feet. --Warren Buffett (paraphrasing an African proverb)[/blockquote]

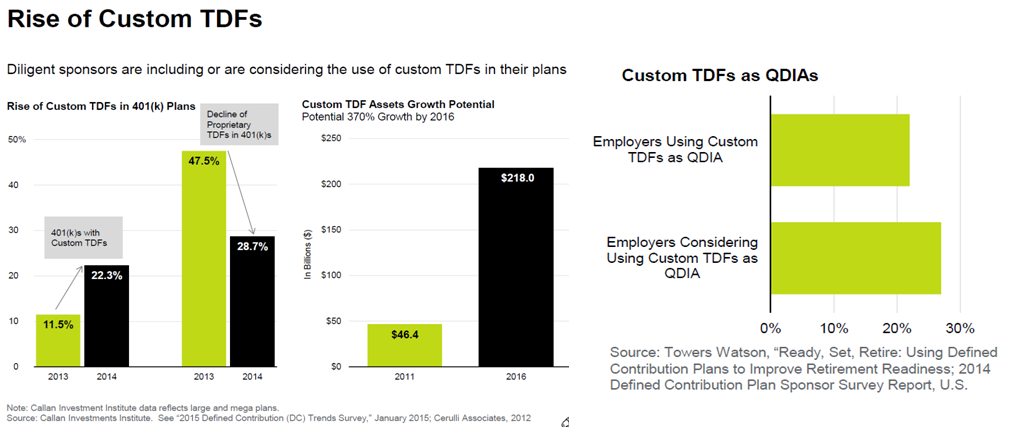

The hottest assets in 401(k)-land are target date funds (TDFs), which blew through the $1 trillion mark in 2015, rising from almost nothing eight years ago. The Custom TDF category has been the fastest-growing segment in this space and is on track to reach $218 billion in assets under management next year, according to Callan Associates, as shown in the graph below. That’s a sizzling growth rate of 36% per year since 2011. Custom target date funds are flaming hot.

The $218 billion forecast for 2016 represents 20% of all TDF assets, and the share is growing. For perspective, each of the Big-3 TDF providers manages about one-fifth of the total TDF pool. Custom products are taking away serious market share from traditional proprietary providers. Towers Watson reports that 22% of employers currently use Custom TDFs and an additional 28% are considering it, potentially more than doubling the usage of these products, as illustrated in the graphic.

The Department of Labor helped create the current interest in Custom TDFs by recommending the products in 2013 in its TDF Tips letter to ERISA plan fiduciaries. The products “can be attractive investment options for employees who do not want to actively manage their retirement savings,” the government advised. But the advantage for investors requires managers to pay close attention to the details for designing and overseeing these funds. Ideally, custom TDFs should align the glide path with participant demographics so that the asset allocation adjusts through time, lowering the risk level to match the financial objectives of investors as they approach retirement.

Advisors have strong incentives to create Custom TDFs because these funds are too important to leave in the conflicted hands of mutual fund companies. When designed properly, Custom TDFs enhance the value proposition for advisors by providing clients with a critical service: managing the asset allocation.

Custom TDFs are complicated

The challenge for advisors who create and manage TDFs is navigating the extra level of work and the heightened fiduciary liability--a liability that could prove ruinous if you’re not careful. Here are just a few of the required tasks:

- Design a custom glide path that matches the TDF’s strategy objective

- Select managers who offer cost-efficient investment services

- Provide ongoing periodic rebalancing, including trade instructions

- Calculate and report performance and fees to employers and participants

The critical task is designing the glide path because asset allocation is the most important determinant of investment results. Accordingly, the key to fulfilling fiduciary responsibilities is formulating an effective and well-documented glide–path methodology. The second-most important consideration is fees. Several lawsuits have been won on the basis of excessive cost structures.

Get help before you jump in with both feet

Advisors who provide custom TDFs should take their fiduciary liability very seriously because they are taking on substantial risks. Lawsuits against retirement plan fiduciaries are routinely being won. Specifically, the Duty of Care mandates creation of the best you can do and so you must make a clear effort to deliver a prudently managed strategy. As a result, it’s wise to document your Custom TDF design in an Investment Policy Statement.

Operationally, maintaining a Custom TDF requires ongoing rebalancing and complex communications with the plan’s record-keeper, plus required reporting. The bottom line: it’s a complicated, laborious, and highly regulated process. For obvious reasons, this is not a productive use of time for financial professionals.

That’s why we’re launching a service to help advisors create and maintain Custom TDFs. TDF Builder simplifies the process by providing a blueprint for prudent design and automation for ongoing maintenance.

TDF Builder offers a time-saving system for remaining in compliance, generating reports, and otherwise streamlining a necessary but complicated facet of target-date-fund management. But perhaps the biggest advantage of TDF Builder is that it provides more time and resources to focus on the top priority in every advisory practice: the clients.

Ronald J. Surz is president of PPCA Inc. and Target Date Solutions in San Clemente, California. He is also CIO of Paladin Financial Technology, TDF Builder, and Sortino Investment Analytics.

Target Date Solutions developed the patented the Safe Landing Glide Path®, the basis for the SMART Funds® Target Date Index collective investment funds on Hand Benefit & Trust, Houston, the only investable target date fund index. Ron is co-author of the Fiduciary Handbook for Understanding and Selecting Target Date Funds. TDF Builder helps fiduciaries design and manage custom target date funds.