5 Ways to Generate Leads off of Your Financial Advisor Website Using Effective Calls to Action

You’ve attracted a visitor to your website. You’ve enticed them to visit a second page about your firm. But how do you turn a visitor into a lead by getting him or her to submit their contact information to you?

The answer: A compelling Call To Action (CTA).

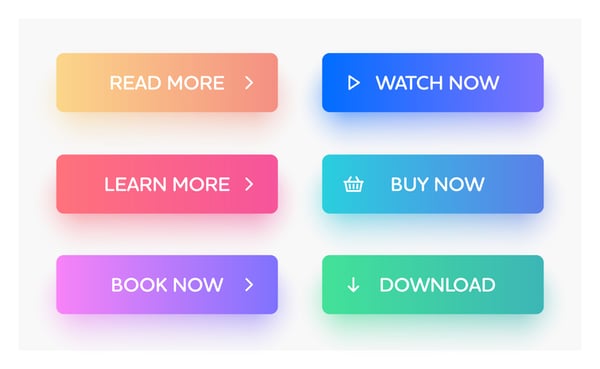

Because an RIA’s business essentially lives or dies on the clients he or she can serve, your online presence must be ready for interested visitors that come calling. This is why every piece of your digital communications must have a CTA – a “button” for a free offer or the specific step you want your audience to do next. Whether this is clicking on a link or signing up to receive your weekly blogs, this “call” to “act” is the key to turning your interested viewers into your best prospects.

But how do you convince your audience to take that necessary next step? How do you create an effective CTA?

Almost all websites already have some form of this, whether it is submitting a request or signing up for a newsletter. But getting a visitor to actually complete your CTA can prove to be trickier. There are lots of factors that come into play when creating a CTA that resonates with your visitors. It should start by identifying the very best audience for your firm and discovering that segment’s motivation.

When it comes to marketing financial planning services and turning visitors into prospects/leads, some factors are more critical than others, such as design, timing and the satisfaction derived when they act.

Create Your CTA By Asking These 5 Questions

1. Who is your target audience?

This may sound obvious, but it is important to nail down specifics about your audience very early in your marketing development, as it should direct every part of your communications. Your target market may change and evolve over time, and it may not even turn out to be the consumers you once imagined. A specialist with strategic, Inbound Marketing tools can not only identify the investors best served by your unique brand, but also show you where best to find them.

2. How do your visitors like their information?

Will your leads prefer a convenient virtual meeting or would they appreciate more traditional face-to-face communication that could be offered through a seminar or workshop? Knowing these preferences about your target can be very helpful to your audience, and their appreciation can shine a favorable light on your firm’s good name.

3. What do they worry about?

When you realize a common concern or pain point for your clients, then you can go to work by offering your valuable help. You may find that a budgeting worksheet will speak to consumers that are never able to save, whereas offering a calculator or a “how-to” guide may be enticing to those concerned with income after retirement.

4. Where are they located?

When you identify where your target audience lives, you may discover that there are specific topics you can highlight that will better encourage your lead to take action. When you can answer the question of “where,” you may find opportunities to speak to your target with information that is geographically relevant and therefore particularly appealing, such as a complimentary eBook titled “6 Tax Breaks Specific To San Antonio.”

5. When are services needed?

Is your target market nearing retirement and in need of investments that produce income? Or are they just starting to build a nest egg for many future goals? Once you know when your prospects may be looking for investment services, then you will know exactly what to offer them and when.

Everybody Loves ‘Free’

No matter what valuable tools or tips you create for your prospects, when you offer these resources for free, you get a natural opportunity to collect their contact information in a low-pressure way. When you generate these viable leads, you then have more opportunity to reach out to them down the road with new and relevant information. This is how you remain forefront in the minds of these interested prospects as an industry expert and service provider. Offering something your prospects really want is a great way to encourage your leads to eventually become your satisfied clients. This is a crucial step in marketing financial planning services.

Find Your Voice

The best CTA phrases are clear and specific. Using the same words and phrases that your leads use is very compelling. Whether you pique curiosity or invite prospects to solve a problem, if your offer is truly relevant, then your CTA can simply highlight this value. Make sure your text is short and sweet because you can quickly lose interest when your message is repetitive or skirts around important questions.

Build Trust

Balancing compelling copy with a human tone is not always easy and comes with practice. This is another important area where an agency with Digital Marketing experience can provide support. There is always a risk with the written word, that it may be misinterpreted as impersonal or aggressive. You never want your visitors to get the impression that they are being called to take action by a faceless corporation, rather than a passionate team of people. Especially when marketing financial planning services.

Web browsers today have an especially low tolerance for anything that sounds like a high-pressure attempt to sell them something. Headlines that are unable to deliver on their claims can undermine the trust that is crucial for turning leads into clients, especially for a financial advisory firm. Aggressive CTAs can be unwelcome to the average consumer who is exposed to up to 10,000 brand messages a day. This barrage of advertising has made much of the market highly skeptical of yet another plea for their attention.

The Right Time

The timing of your CTA is also very important to consider. When presented at the wrong time, your message could just be a distraction. This is why your communication should also be based on relevant factors like where the leads are on your site when they find a CTA as well as where they are in their journey for investment services. This journey of a typical consumer refers to the fact that most investors become clients only after more than one contact. This makes the need for different CTAs necessary for different visits and consumer stages, and even tailored to the products or topics a lead has recently viewed.

An Inbound Marketing agency for RIAs can address important specifics like these for you in order to ensure each CTA hits the target.

Your Pictures Speak a Thousand Words

Your CTA itself may be very simple, but the next step is how to pair this straightforward text with visually compelling graphics to produce results. Design, function and layout will give your web messaging important navigational cues that tell your leads where to read and click. When you speak with an Inbound Marketing firm that specializes in assisting financial advisors, you will get specific strategies to answer the “who, what and how” necessary to create an effective CTA. With strategic planning and creative development, you take all the guesswork out.

Paladin Digital Marketing has been specializing in serving financial advisors for years with proven strategies that generate results. If you are ready to call your interested leads to take action and join your list of satisfied clientele, the best approach is often with a specialist by your side.

Contact Paladin Digital Marketing to see how we can help.