Markets Opportunity is Knocking - Our 90 Year History

This is the third, and last, segment of my 3-part commentary. Part 1 discussed 2015 and the past 5 years. Part 2 looked into the future, identifying momentum and reversal possibilities. Now this commentary looks back over the past 90-year history of capital markets.

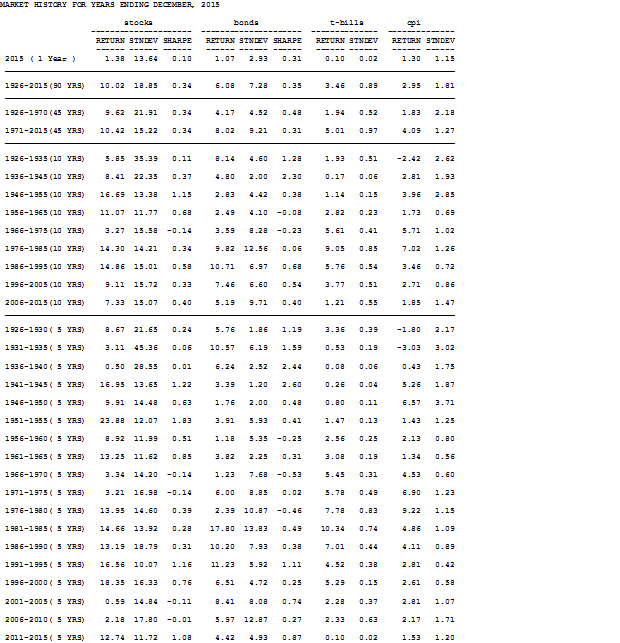

The table below shows the history of risk and return for stocks (S&P 500), bonds (Citigroup high grade), T-bills and inflation. There are many lessons in this table, so it’s worth your time and effort to review these results. For example, here are a few of the lessons:

- T-bills paid less than inflation in 2015, earning 0.1% in a 1.3% inflationary environment. We paid the government to use their mattress, as we have for the past ten years, with a 1.21% return in a 1.85% inflationary environment.

- Bonds were more “efficient,” delivering more returns per unit of risk than stocks in the first 45 years, but they have been about as efficient in the most recent 45 years. The Sharpe ratio for bonds is .48 versus .34 for stocks in the first 45 years, but the Sharpe ratio for both is the about the same in the more recent 45 years. Both stocks and bonds have returned about .32% per unit of risk.

- Average inflation in the past 45 years has been more than twice that of the previous 45 years: 1.83% in 1926-1970 versus 4.09% in 1971-2015.

- Bonds returned 2% above inflation in the first 45 years, and that doubled to above 4% in the past 45 years.

- Stock market volatility was much higher in the 20-year period 1926-1945 than it has been since. Volatility subsided from 20-35% down to 15% in the most recent 70 years.

- By contrast, bond markets have become more volatile, more than doubling in the most recent 45 year to 9.23%, versus 4.52% in the first 45 years.

Source: PPCA Inc

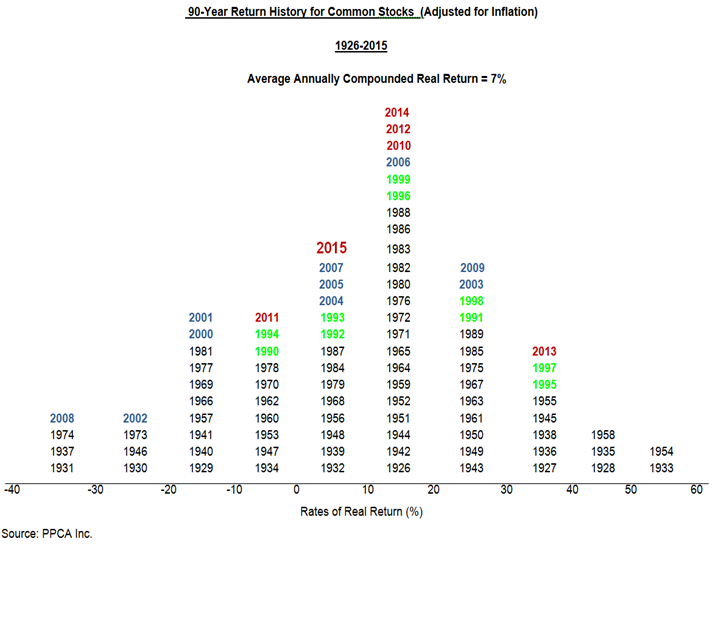

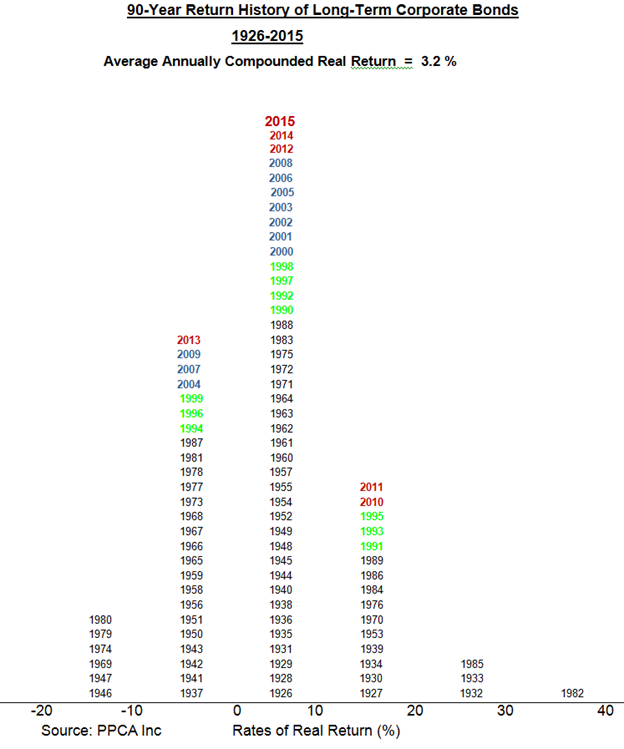

Additional perspective is provided by the following histograms of stock and bond returns.

Ronald J. Surz is president of PPCA Inc. and Target Date Solutions in San Clemente, California. He is also a partner and CIO of Paladin Financial Technology, TDF Builder, and Sortino Investment Analytics.