Hedge Fund Peer Groups Are Hazardous To Your Wealth

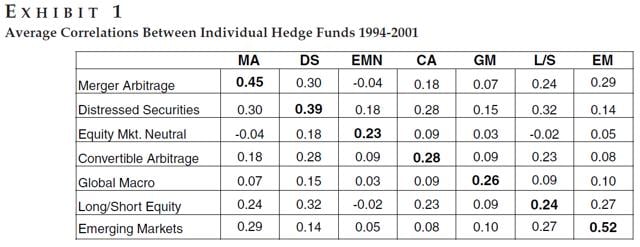

Hedge fund peer groups are nonsensical because hedge funds are unique. The definition of “unique” is without peers. You can group unique, but you should call it hodgepodge. In his seminal "10 Things Investors Should Know About Hedge Funds," Dr Harry Kat documents a big problem with hedge fund peer groups. Funds in these peer groups do not belong together, because their performance is not correlated. They behave differently.

Consider, for example, "market-neutral." This very popular strategy comes in many forms - dollar, beta, style, sector - the list goes on, and many funds that call themselves market-neutral should not. Kat finds correlations to be a mere 0.23 among funds in market-neutral peer groups, substantiating the fact that these funds are different from one another. These funds do not belong together. Consequently, hedge fund managers win or lose based on beta rather than alpha.

Back to the Basics

Hedge fund due diligence can be distilled down to two crucial questions:

- Do we like the strategy that this manager employs?

- Does this manager execute the strategy well?

Common hedge fund due diligence, as it is practiced today, answers the first question with hot performance, and accepts conceit and concealment as answers to the second.

This is a shame, because investors have been shammed by fake due diligence. The Madoff and Stanford scams were enabled by the due diligence sham. Here's a simple 2-step due diligence approach that is rigorous and sham-free.

(1) The adage "Don't invest in what you don't understand" is particularly relevant to hedge fund investing. To address this issue, we recommend that the researcher complete a fairly straightforward profile like the following:

Sample manager profile

- Approach long: Exposures to styles, sectors, countries, etc., as well as exposures to economic factors

- Approach short: Exposures to styles, sectors, countries, etc., as well as exposures to economic factors

- Direction: Amounts long and short

- Leverage

- Portfolio construction approach: Number of names, constraints, derivatives, etc.

If we can't complete this profile, we don't invest. That's the deal. If we can complete this profile, we can move on to the question of manager competence. The profile gives us the option of replicating or hiring (make or buy), so we want to know that value-added exceeds fees.

(2) Perform scientific tests of manager competence: There's nothing worse than a mediocre doctor or a mediocre hedge fund manager. Albert Einstein once said, "The problems we face today cannot be solved at the same level of thinking that created them." A corollary is that it's unlikely that the people who created the problems can succeed at fixing them.

The solution to the problems with peer groups and indexes is actually quite simple, at least in concept. Performance evaluation ought to be viewed as a hypothesis test where the validity of the hypothesis "performance is good" is assessed. To accept or reject this hypothesis, construct all of the possible outcomes and see where the actual performance result falls. If the observed performance is toward the top of all of the possibilities, the hypothesis is correct, and performance is good. Otherwise, it is not good. In other words, the hypothesis test compares what actually happened to what could have happened.

Using the profile described above, a computer simulation randomly generates portfolios that comprise a custom scientific peer group for evaluating investment performance. A reported return outside the realm of possibilities is suspicious, and can be explained in one of three ways: The return is, in fact, extraordinary; the return is fraudulent; or we do not understand the strategy.

Of course, the test itself cannot tell us which of the three possibilities is the reality, but it does give us motive to look. In other words, the hypothesis test either validates the credibility of reported performance or provides the wherewithal to question the incredible. Financial audits are not designed to provide this validation.

The Challenge of Change

Behavioral scientists tell us that we are all hard-wired to resist change. We want to continue to use hedge fund peer groups. Advocates of change preach "change talk," the language of overcoming the challenge of change. We need to hear and understand the disadvantages of the status quo and to appreciate the benefits of a new, improved future. Most importantly, people need to listen, so the message should be entertaining. That's why we produced a short video on the Future of Hedge Fund Due Diligence and Fees to re-frame your thinking.

In the future, we won't pay much for hedge fund exotic betas (risk profiles). We'll pay for superior human intellect instead. We'll know the difference, because we'll abandon simple-minded performance benchmarks like peer groups and indexes, and replace them with smart science. Disruptive innovation will elevate our comprehension and contentment. Everybody will win.

Ronald J. Surz is a partner and CIO of Paladin Financial Technology. He is also president of PPCA Inc.and Target Date Solutions and a partner of TDF Builder, and Sortino Investment Analytics.