Financial Advisor Website Metrics That You Should Be Tracking

Your most powerful marketing tool is your website, but only if it produces qualified leads for your firm. If it does not produce leads, then it is functioning as nothing more than an online sales brochure. It provides information about your firm, but it does not produce results that help you grow your firm.

Using Google Analytics or other analytical tools, you can gain some valuable insights into how you can use your website metrics to better understand how visitors are interacting with your site and make it more productive.

We surveyed 164 registered investment advisory firms that comprise our findings in this article.

Google Analytics

Google offers a free analytics tool that is easily installed on websites. It offers an extraordinary amount of website analytic data that will tell you how visitors are interacting with your website and how effective the site is from a user/visitor experience.

42 financial advisory firms, out of the 164 (25.6%) that we contacted for this study, were running Google Analytics on their websites. We used the Google Analytics data to produce the statistics and observations in this article.

Ironically, only 19 of the 42 financial advisors (45.2%) who had Google Analytics said they knew how to interpret the data. Consequently, more than 50% of the financial advisors had the data, but they were not using it to manage the content and offers on their websites.

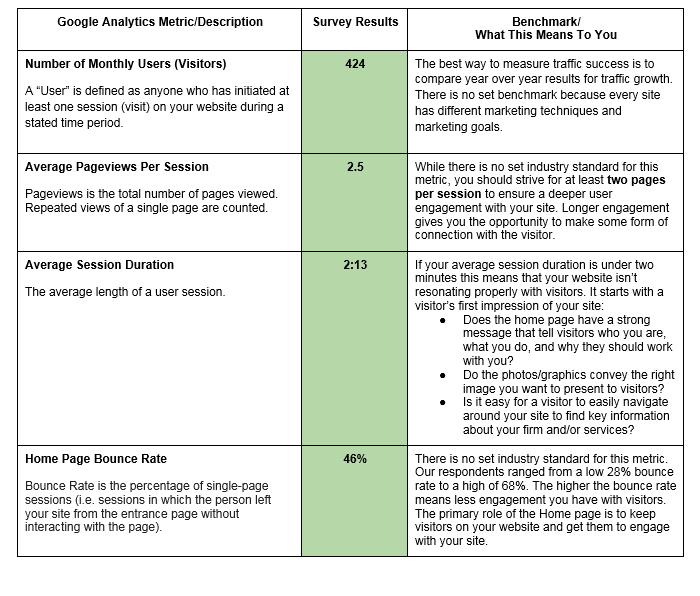

The table below includes the survey results as well as benchmark standards for each metric.

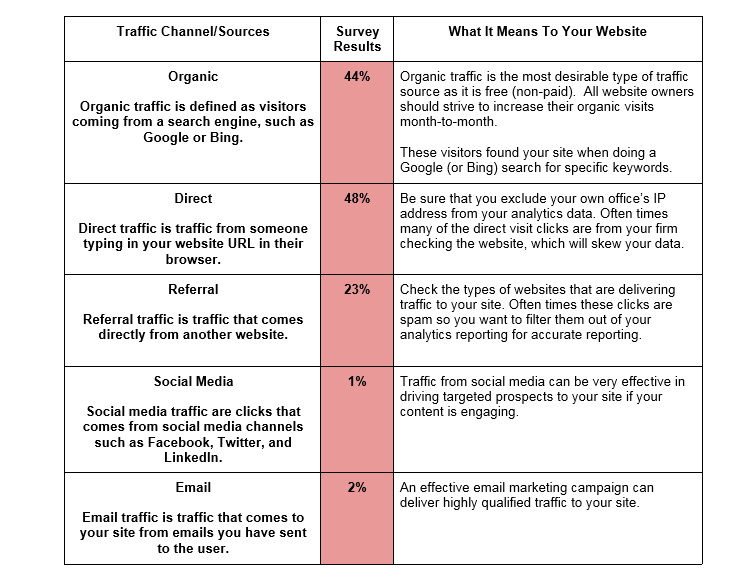

The other critical component to understanding how your site is performing is to analyze where your website visitors are coming from. Google Analytics calls these “Channels”. Channels or traffic sources, are divided into six primary categories that we recommend you track. These sources will give you a much more in depth understanding of how people find your site and how effective each channel is.

Example: Your website is getting a large number of clicks from the Referrals Channel. After closer examination of the data, you determine that your site has been getting clicks from a site that is not in the United States and is not a legitimate site which is skewing your data. In this instance, you should exclude that site from your Google Analytics data so any further activity by the site will not reflect in your tracking totals.

For purposes of this survey, we compared the total average monthly website visitors against the number of clicks received from each channel.

Use of Inbound Marketing Technology

The top three performing websites in our survey in terms of the metrics shown above are all using various forms of inbound marketing on their websites including: free offers with engaging landing pages, consistent blogging, social media outreach, and email marketing.

These inbound marketing techniques help engage visitors with their websites and generate prospects.

Conclusion

As our industry and marketing methods evolve into more digital interactions with prospects and clients, it’s crucial for every financial advisor website owner to have a basic understanding of how your site is currently performing.

Even if you track the basic analytics noted above on a monthly basis you will have a much better understanding of how your site is performing and how visitors are interacting with your site.

If you don’t have the time, expertise, or interest, then hiring a firm who can conduct more thorough analysis and then make recommendations to you about improvements would be a smart move.